tempe az sales tax rate 2020

2020 Arizona Sales Tax Rates The following are a breakdown of the Retail Sales Tax Rates for most of the major cities in the Phoenix metro area. Average Sales Tax With Local.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Groceries and prescription drugs are exempt from the Arizona sales tax.

. Arizona has recent rate changes Wed Jan 01 2020. Use the physical address or the zip code or if it is unknown the Map Locator link can be used to find the location. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25.

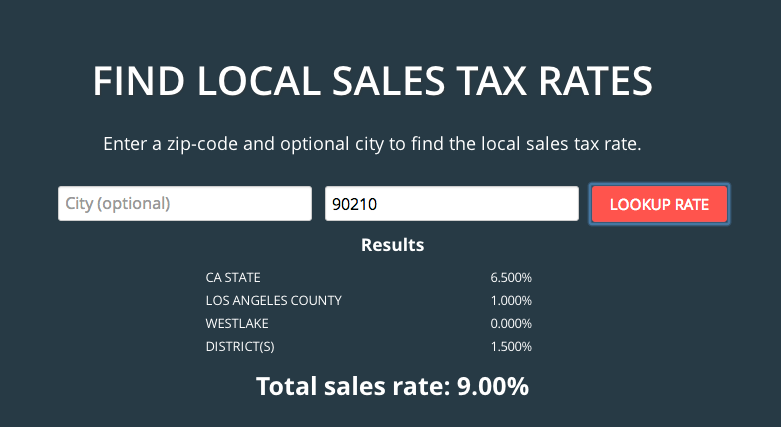

23 lower than the maximum sales tax in AZ. When combined with the state rate each county holds the following total sales tax. For tax rates in other cities see Puerto Rico sales taxes by city and county.

The Tempe sales tax rate is. The state sales tax rate in Arizona is 5600. The current total local sales tax rate in Tempe.

The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07. City of Tempe Maricopa County Arizona State. For tax rates in other cities see Arizona sales taxes by city and county.

Sales tax in Tempe Arizona is currently 81. 6th St 3rd Floor. 2 The Maricopa County transient lodging rate of 177 includes 1 per Prop.

No School No School. Cochise County 61 percent. 4 rows Tempe Junction AZ Sales Tax Rate.

There is no applicable special tax. You can print a 86 sales tax table here. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts.

As Of July 1 2014. City of Tempe except City holidays Tax and License. There is no applicable special tax.

Greenlee County 61 percent. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. This tax does not apply to.

Maricopa County 63 percent. The minimum combined 2022 sales tax rate for Tempe Arizona is. 6 rows The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and.

With local taxes the total sales tax rate is between 5600 and 11200. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

As of 2020 the current county sales tax rates range from 025 to 2. Title 42 Chapter 5 Article 10 with collecting the excise tax imposed only by the state and transaction privilege tax state counties and cities imposed on adult use marijuana sales. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona.

Arizona has state sales tax of 56 and. Gila County 66 percent. Apply for TPT License.

Arizona has 511 special sales tax jurisdictions with local sales taxes in. Combined Privilege Tax Rates. The 86 sales tax rate in Phoenix consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 23 Phoenix tax.

This is the total of state county and city sales tax rates. Did South Dakota v. Apache County 61 percent.

The 81 sales tax rate in Tempe consists of 56 Puerto Rico state sales tax 07 Maricopa County sales tax and 18 Tempe tax. Arizona Hospitality Research and Resource Center AHRRC Revised January 2020 3 Transient lodging in unincorporated areas of Pima County is subject to a 6 county tax effective 1106. Select the Arizona city from the list of popular cities below to see its current sales tax rate.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. Pinal County 72 percent. Wayfair Inc affect Arizona.

You can print a 81 sales tax table here. The Arizona sales tax rate is currently. Monday - Friday 8am - 5pm.

What is the sales tax rate in Tempe Arizona. Arizona Tax Rate Look Up Resource. Tempe 250 560 Tolleson 320 560 Wickenburg 290 560 Youngtown 370 560 Pinal County Local General Sales Tax AZ State Sales Tax.

File Pay TPT Monthly AZTaxesgov. Office Address Mailing Address. The County sales tax rate is.

Tempe AZ 85280 salestaxtempegov. 20 Use Taxable Purchases 18 56 74. Tempe Tax License.

The Arizona Department of Revenue ADOR is tasked in ARS. Not Taxed By State County MCTC Section 445.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

What S The Arizona Tax Rate Credit Karma Tax

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Arizona Sales Tax Small Business Guide Truic

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa

How To Collect Sales Tax Through Square Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Residential Commercial Rentals City Of Tempe Az

Arizona Sales Tax Small Business Guide Truic

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa

Is Food Taxable In Arizona Taxjar